According to Supply-side Economists Lowering Corporate Income Taxes

Bush courts supply-side economists before releasing tax plan US. These policies are commonly associated with and characterized as supply-side economics trickle-down economics or voodoo economics.

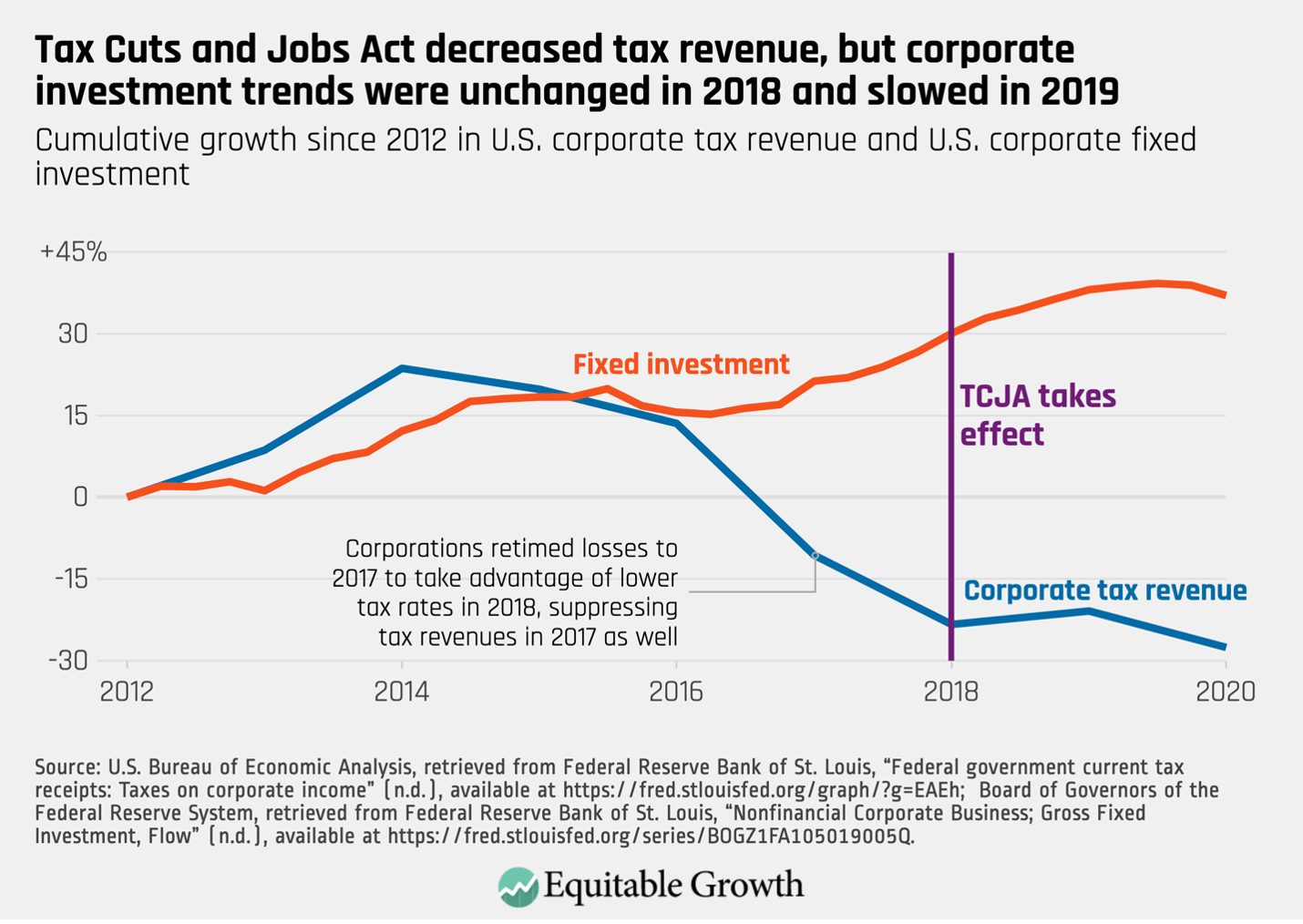

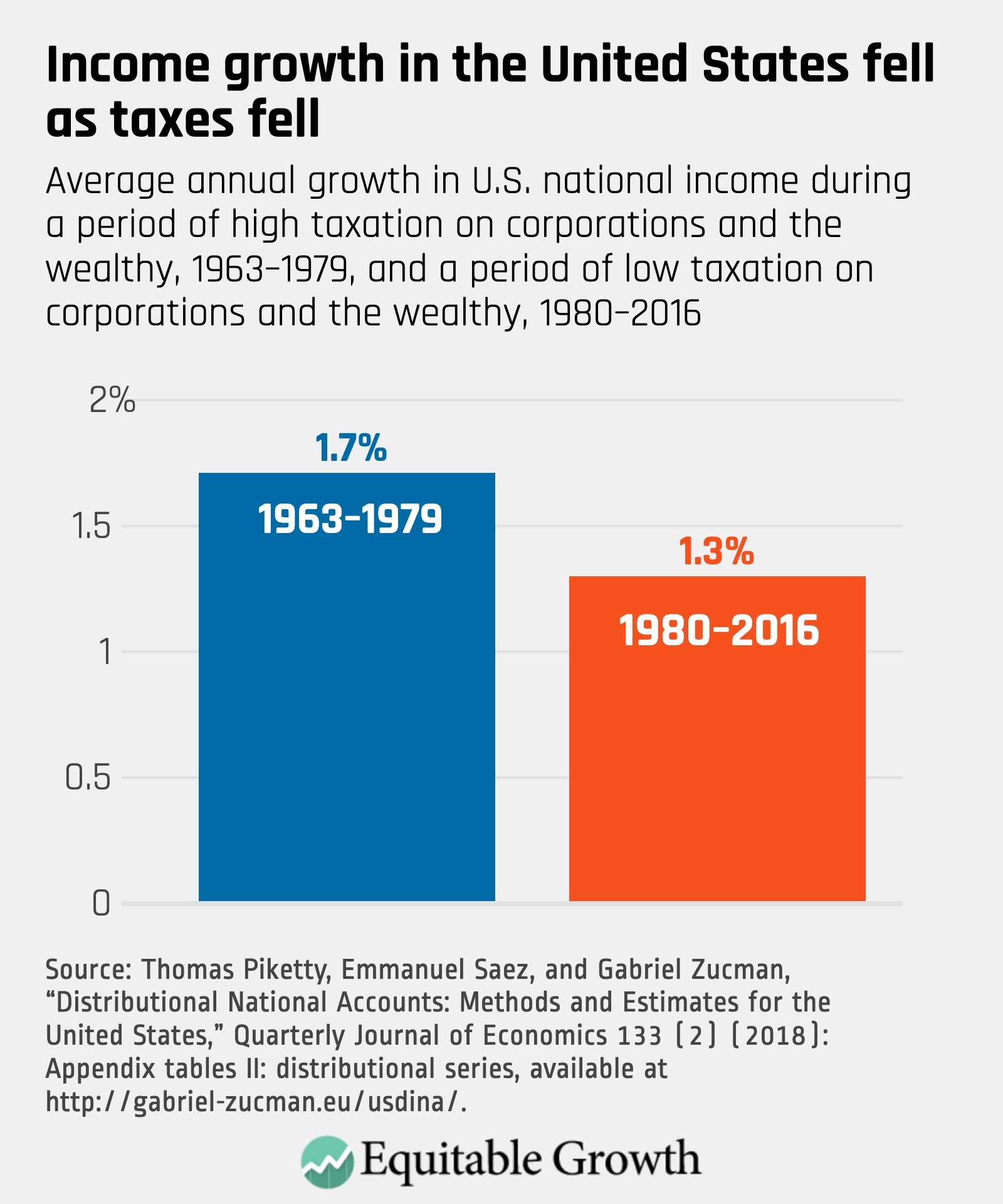

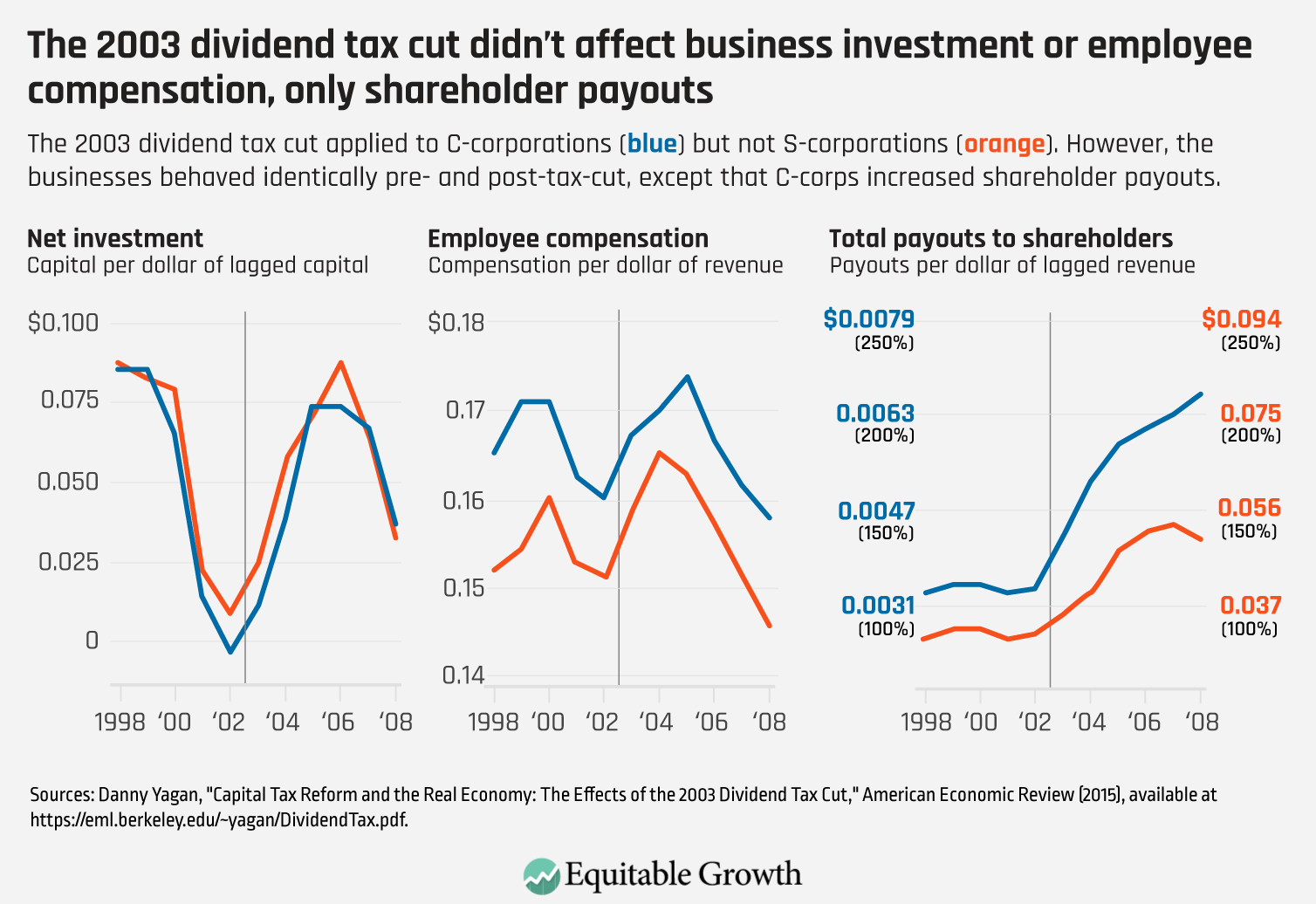

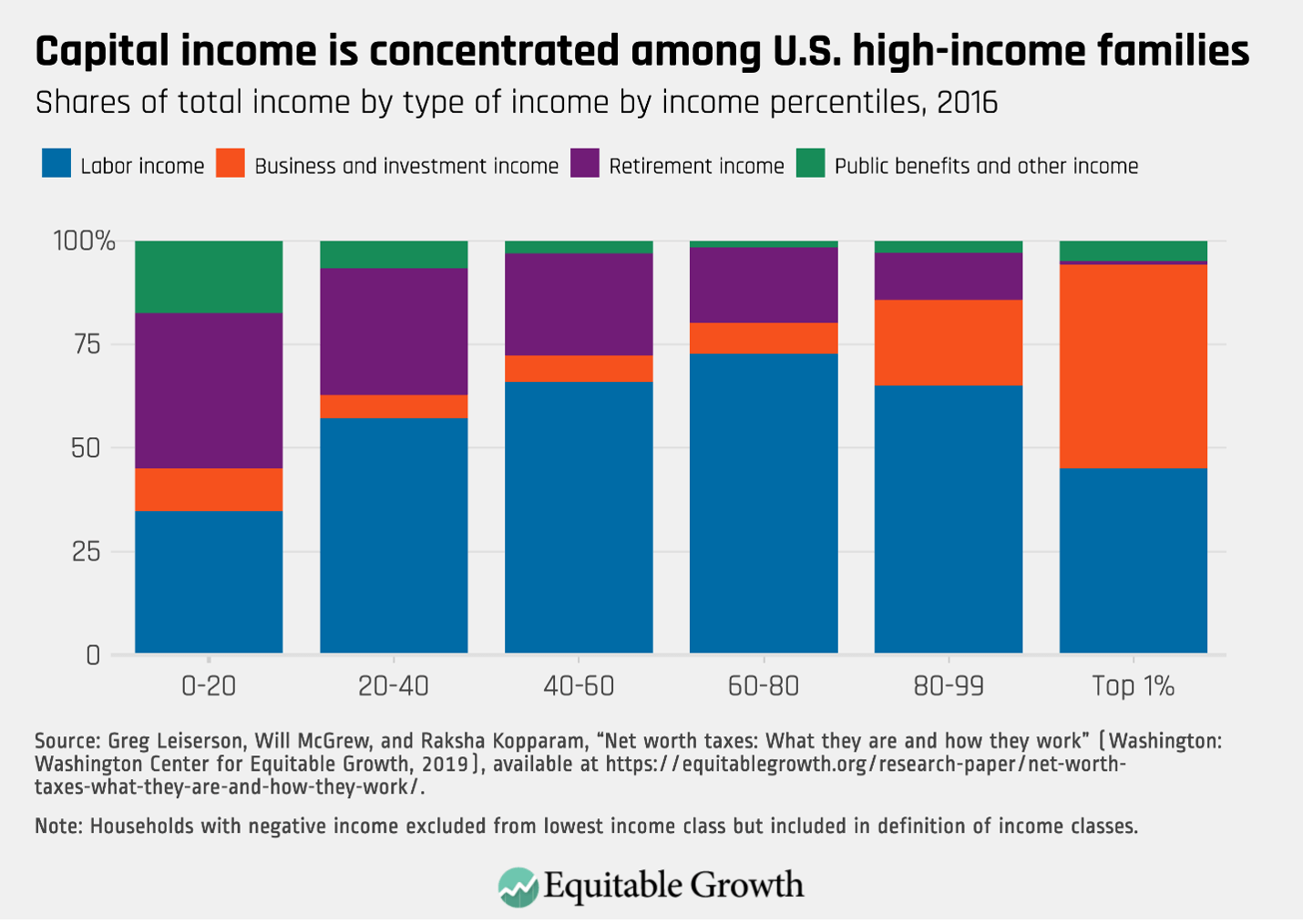

The Relationship Between Taxation And U S Economic Growth Equitable Growth

Results in wage hikes for employees but no economic growth.

. First debt-financed tax cuts will tend to boost short-term growth as in standard Keynesian models and in the literature using the narrative approach but. Because Congress passed this. The hope is that these individuals use tax cuts to their advantage to make investments hire additional employees and complete other business initiatives that help stimulate the economy.

Reaganite supply-siders argued that lower tax rates on individuals and companies as well. Second a lowered business income tax can. Corporate tax cuts do a little better.

In recent years this latter use of the term has become the more common of the two and is thus the focus of this article. The 92 tax bracket applied to income over 400000 in 1953. The Tax Reform Act of 1986 reduced the top personal income tax rate to just 28 from 50 and the corporate tax rate to 34 from 46.

Labour supply arises from a balancing act between after-tax income and leisure economists suppose that workers want but cannot have more of both. Checks the expansion of GDP and employment. On aggregate they cut the top tax rate to 35.

At the same time most supply-side economists though perhaps not all noted that reductions in low tax rates would lead to revenue losses. Supply-side economics is also used to describe how changes in marginal tax rates influence economic activity. He deplored them both.

A study by the National Bureau of Economic Research found precise figures on how much revenue will be recouped by tax cuts. Moves society toward greater income equality. According to supply side economists lowering corporate income taxes.

A results in wage hikes for employees but no economic growth B moves society toward greater income equality C checks the expansion of real GDP and employment. Even though prosperity doubtless does reduce the illusory need inside the electorate for more government the wonderful supply-side revolution that began realistically in the late 70s and took. The experiment in Kansas has important implications for federal tax reform the first being not to expect tax cuts to boost the economy much if at all.

He also would lower the corporate tax rate to 125 percent barely a. But not all else is equal. Increase the price level.

D stimulates investment and spurs on economic growth. Stimulates investment and economic growth E. When taxes go up after-tax income dips and this would all else equal dip the balance towards choosing more leisure and less work.

Checks the expansion of real gdp and employment D. But the historical experience tells us this theory is nonsense. Results in higher wages without creating higher levels of labor productivity.

Does not create enough incentive for producers to increase production. What is supply-side economics. Results in age hikes for employees but no economic growth.

Eisenhowers quote is often put in the context of the fact that the top marginal income tax rate in 1953 was 92. The lower tax rates enacted in the early 1980s were intended to a. But during the Reagan years the phrase supply-side economics took on a narrow politicized definition.

A cut in the. But Gingrich has gone much further proposing to eliminate taxes on capital gains and other investment income altogether. Bush cut taxes in two packages one in 2001 and in 2003.

Stimulates investment and economic growth. This is what is called supply side economics By lowering taxes people will more of an incentive to work and invest. Creates greater income equality.

For each dollar of income tax cuts only 17 cents will be recovered from greater spending. Change in top income tax rate. Moves society toward greater income equality.

According to supply-side economists lowering corporate income taxes a. Studies That Dont Support Supply-Side Economics. Supply-side economics describes when wealthy individuals or large corporations receive tax cuts.

According to supply-side economists lowering corporate income taxes. D fall during a recession thus reducing the severity of the recession. Reaganomics r eɪ ɡ ə ˈ n ɒ m ɪ k s.

According to supply-side economists lowering corporate income taxes. Decline in spending employment profits and incomes result in lower tax income Public expenditures increase on aid to the victims unemployment benefits food. Republican presidential candidate Jeb Bush answers a question from the audience during a campaign town hall meeting in Laconia N.

Increase the supply of labor. President Ronald Reagan during the 1980s. Supply-side economists believe that high marginal tax rates strongly discourage income output and the efficiency of resource use.

A portmanteau of Ronald Reagan and economics attributed to Paul Harvey or Reaganism refers to the neoliberal economic policies promoted by US. Checks the expansion of real GDP and employment. D stimulates investment and economic growth.

Stimulates investment and spurs on economic growth. The corporate tax leads to lower returns on capital lower wages or higher prices and most likely a combination of all three. According to the supply-side view the combination of a decline in tax avoidance and increase in business activities would permit lower rates with little or no loss of revenues in the top tax brackets.

The Relationship Between Taxation And U S Economic Growth Equitable Growth

The Relationship Between Taxation And U S Economic Growth Equitable Growth

The Economic Impact Of Tax Changes 1920 1939 Cato Institute

The Relationship Between Taxation And U S Economic Growth Equitable Growth

0 Response to "According to Supply-side Economists Lowering Corporate Income Taxes"

Post a Comment